Design and structuring of impact investment vehicles.

We offer tailored advice and services according to our clients’ needs and desired impact.

Our services range from design and structuring of different impact investment vehicles or tools, to the complete implementation and management of the initiative launched.

We have experience in the development of Impact Investment Funds, Outcome Payment Contracts, Social Impact Bonds, and the development of ICMA Aligned Green, Social and Sustainable Bonds frameworks, among others.

Strategic advisory and impact management

We provide strategic advice to clients within the governmental, multilateral, corporate, financial and non-profit sector in the development and diversification of their fundraising and impact investment strategies; including the incorporation of best international practice in their impact management and reporting.

- Our clients include:

- Banks: Banco Interamericano de Desarrollo, Banco de Desarrollo Productivo de Bolivia, Banco de Galicia y Buenos Aires, ASOBAN, Tarjeta Naranja

- Governments: Mesa Técnica de Finanzas Sostenibles de Argentina, Gobierno de la Provincia de San Juan

- Non-profit organisations: Fairtrade International, Pro Mujer International, Save the Children

- Social Enterprises: Fundación Zambrano, Fundación Compromiso, Grid X

- Investment Funds: NXTP Ventures, Puerto Asís Investments

Market and field building

We developed and manage key peer networks for the development of the impact investment ecosystem in Latin America such as the Impact Investment Task Force for Argentina, Paraguay and Uruguay, the Latin-American Outcomes Payment network with peers in Brazil, Colombia, Chile and Mexico, and the LATIN SIF (now part of the UNPRI).

We develop market research and intelligence both as a public good and for specific clients. Please see reports

We successfully concluded the first Social Impact Bond in Argentina!

And we are raising the bar to create the first Outcomes Fund focused on youth employment in the country, and one of the first ones in the region.

The first Social Impact Bond in Argentina focused on the employability of vulnerable youth in the south of the City of Buenos Aires, and was implemented between December 2018 to May 2022.

89% of participants finalized the capacity building program

36% entered into formal employment

76% remained in employment for 4 months

59% remained in employment for 12 months

Un launched the Gender Platform

Together with Pro Mujer and financed by USAID DAI we developed and launched the Gender Platform, a one stop shop with latest data, best practice, tools, and support needed so that financial institutions across Latin America and globally can develop their strategies and gender lens investment products and learn from peers.

Visit websiteWho we are

We have the experience developing the solutions, opportunities and vehicles through which investors can align capital with purpose, to catalyse lasting economic and social change.

We know that investment has the power to achieve the change we want to see happen in our lifetime, at the speed and scale needed.

We are driven by the conviction that building a thriving, inclusive, and sustainable economy represents a unique opportunity to shift course for Latin America

WE EXIST TO MAKE THIS HAPPEN

WE ARE ACRUX

Services

We tailor our strategic advice and solutions to client needs, which include private equity and venture capital funds, family offices, banks, governments, multilateral agencies, non-profit organisations and corporates.

We bring more than two decades of experience in sustainable finance and impact investment, to add value to our clients, providing practical and results focused solutions. We specialize in thinking “outside of the box” and adapting the solutions and innovation needed to our client’s needs.

1. Strategic advisory and impact management

We advise and support our clients in the development and diversification of their sustainable and impact investment strategies and fundraising activities. We support them in implementing the strategies and develop a robust impact management practice. Our services include:

- Theory of Change development

- Development and evaluation of impact indicators and KPIs

- Development and implementation of impact monitoring and evaluation tools

- Digitalization of impact reporting

- Impact evaluation and reporting

2. Structuring of impact investment vehicles and products

Advise in the development and structuring of impact investment vehicles or instruments, including:

- Impact investment funds

- Outcome payment contracts and Social Impact Bonds

- Development of ICMA Aligned Green, Social and Sustainable Bonds frameworks, among others

- Wholesale impact funds

Our services adapt to the client needs, and range from the design and structuring to fund management.

3. Training and capacity building

4. Market intelligence and field building

We develop market research and information as a public good and for private clients.

We forge and work within and through networks.

We produce in depth market research and market intelligence.

We work in alliance with other like-minded organisations to promote the development of sustainable finance and impact investment at a global level.

Team

We have a multidisciplinary team with diverse expertise that includes specialists in finance, management, development and impact measurement.

Together we can provide multi-dimensional solutions to our clients and the projects we work on, from governments to private investors and companies, generating value in everything we do.

Acrux has a unique network of pro-bono advisors, experts in areas including: investment and finance, financial innovation, regulatory and legal frameworks, management, entrepreneurship, international development and impact investing, who motivate, challenge and support us to think "outside the box" and find innovative solutions to complex problems.

María Laura is the Director of Acrux Partners and Strategic Business Development Advisor for Pro Mujer International.

SEE MOREMARÍA LAURA TINELLI

Director & Co Founder

María José Castelli, works as Project Manager in Argentina. María José has many years of experience in the labour market both...

SEE MOREMARIA JOSÉ CASTELLI

Project Manager in Argentina/Uruguay

Flavia is the Impact Director at Acrux Partners, leading impact evaluation and measurement projects as well as research...

SEE MOREFLAVIA TINELLI

Impact Director

Agustina works as an Analyst at Acrux Partners. She has experience in various sectors: government, academia, private...

SEE MOREAgustina Zamprile

Analyst

Juan María works as a consultant specialized in project management and has extensive experience leading work teams...

SEE MOREJuan Maria Abal

Advisor

Florencia has more than 8 years of experience in planning social and environmental projects in public and...

SEE MOREFlorencia Casas

Project Planification

Juan Savino has been an Advisor to Acrux since 2015, and is in charge of Investor Relations for Lexington Partners in...

SEE MOREJUAN SAVINO

Advisor

Federica has been an advisor to Acrux since 2022, having previously been in charge of new business development in Uruguay and Latam.

SEE MOREFEDERICA ABELLA

Advisor

Constanza Connolly is co-founder of Keidos impacto legal, a consulting firm focused on generating, facilitating and/or scaling...

SEE MORECONSTANZA CONNOLLY

Counsel

Adolfo has been a consultant at Acrux since 2020. His area of expertise is project management, developed from a varied professional...

SEE MOREADOLFO DIAZ VALDEZ

Advisor

Damian Gerbasi served for 2 years as an Investment Associate for Acrux and is now a strategic ally of the organization. His work...

SEE MOREDAMIAN GERBASI

AdvisorMilestones

2015

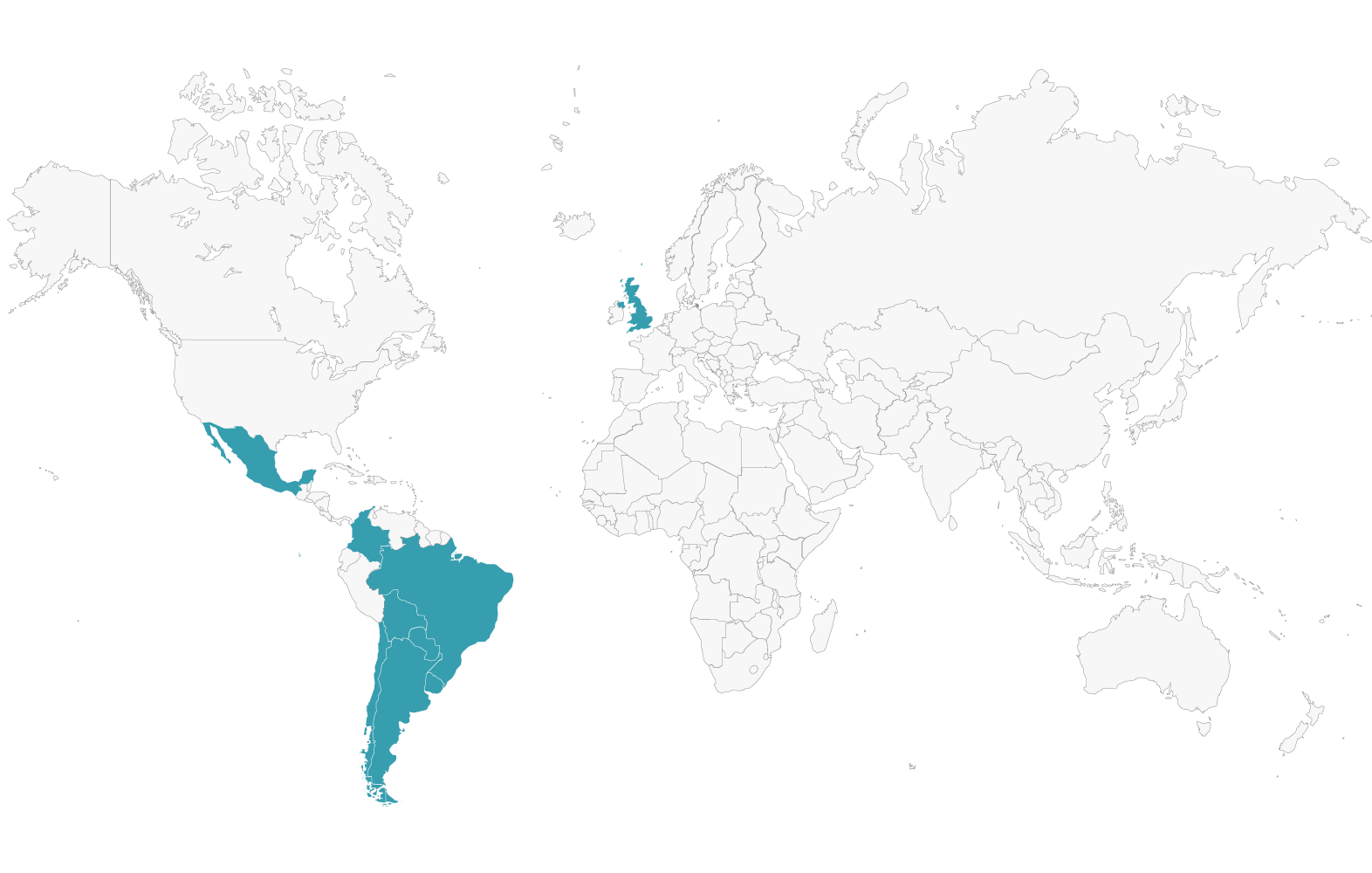

We created and lead the Impact Investing Working Group for Argentina, Paraguay and Uruguay and we represent Argentina in the Global Steering Group on Impact Investment.

Co Launch with the BID FOMIN the call for an Impact Investment Fund for Argentina, Paraguay and Uruguay. Getting the MIF to place up to 10% of the total Fund. $5 million

2019

We launched the Latin American Network of Payment for Results with counterparts from Mexico, Brazil, Colombia, Chile and the UK

2020

Development for PNUD of an in-depth study for Argentina, Paraguay, Uruguay and Chile on the demand for impact capital for the development of investments aligned with the identified needs.

2021

Development for ONU Woman of two studies on investments with a focus on gender in Uruguay and Chile

We created two working alliances: Pro Mujer, leading organization in the region that works on the empowerment of women in Latin America; and with Keidos, an impact legal consultancy for sustainable development.

2022

Together with Pro Mujer and financed by USAID we concluded a fantastic Project to mainstream a diverse and more nuanced gender-lens into the investment strategies of mainstream financial sector actors in Latin America. The USAID-funded project titled PRO MUJER AND ACRUX PARTNERS: Mainstreaming Gender Smart Investment Strategies among Institutional and Commercial Investors in Latin America included a technical assistance (TA) component to support key financial sector actors to recognize gender gaps in both their internal processes and external business activities that could prevent the full inclusion of diverse and minority women’s access to financial services, capital or institutional decision-making processes.

Financed by Fundación Avina under the INDELA Fund we delivered a series of capacity building sessions for non profit organisations to develop their impact strategy and managemet practices.

2016

Acrux begins operations in Argentina helping investors and companies develop viable investments seeking positive financial, environmental and social returns in Latin America.

2017

With GCBA, BID Lab y Social Finance UK We develop and coordinate the offer of the First Social Impact Bond of Argentina in employability of vulnerable youth.

We act as performance managers and administrators of the Social Impact Bond of the City of Buenos Aires in employability of vulnerable youth. We lead the feasibility study and design of an Education Impact Bond for the province of Salta, Argentina

2019

We work with the Agencia de Inversiones de San Juan in the development of an investment fund with social and environmental impact in conjunction with PNUD Argentina.

We developed the feasibility study and the design of a pay-for-results contract to work on the issue of refugees and displaced persons in Argentina.

2020

Desarrollo en conjunto con la Red de Banco de Alimentos Argentina and the Fundación Alimentaris of a payment-by-results scheme to improve the nutritional quality of the food delivered

2021

2021 We developed consultancies for the design of impact strategies for Fundación Compromiso, Tarjeta Naranja and Pro Mujer Internacional.

2020-2021

We work with PNUD Bolivia in the development of an impact measurement system for the Productive Development Bank, for the socioeconomic recovery of MIPYMES

Together with the Productive Development Bank of Bolivia, we developed the country's first Sustainable Bond aligned with SDG Standards (SDG Impact UNDP) ICMA

2021-2022

2021-2022 We work with UNDP Bolivia in the development of an impact measurement system for ASOBAN, which measures the impact of Bolivian banking on compliance with the SDGs.

2020

Acrux starts operations in Uruguay.

2015

Acrux establishes itself in the United Kingdom seeking to connect highly developed impact and responsible investment markets with developing ones.

2020

The Director of Acrux was named a Fellow of Practice in Go Lab, of the University of Oxford in the UK, leading to an investigation into the use of Sibs in the region.

Publications

2016-2021 FIRST 5 YEARS

Acrux Partners was established in 2015 in the United Kingdom and in 2016 in Argentina, to connect capital and innovation in sustainable finance and impact investing between developed and developing markets, supporting investors, companies and actors to develop viable investment opportunities that seek a positive financial, environmental and social return in Latin America.

Mapping of investments with a gender perspective in Chile

This work forms part of the work headed by UN Women under the programme “Win-Win: Gender equality means good business”, a strategic partnership between UN Women, the ILO and the European Union, aimed at

Mapping the situation of impactful investments with a gender perspective Uruguay

Agenda 2030 for Sustainable Development is a frame- work of action for the adoption and implementation of policies and practices to surmount the challenges of environmental, economic and social development,

Bonos de impacto social en América Latina

IDB Lab's pioneering work in the region. Lessons learned

The Impact Principle

Widening participation and deepening practice for impact investment at scale

Catalysing an Impact Investment Ecosystem

Working Group Report from The Global Steering Group for Impact Investment

Inversión de Impacto en Argentina

An opportunity for the country's sustainable development

Inversión de Impacto en Chile

Opportunities and challenges in a market with great potential

Inversión de Impacto en Paraguay

Opportunities and challenges of a market with enormous potential.

Building Impact Investment Wholesalers

Key Questions in Design of an Impact Investment Wholesaler. Working Group Report from The Global Steering Group for Impact Investment.

Inversión de Impacto en Argentina 2017

The following report is made as part of the work and actions of the Mesa Ejecutiva de Inversion de Impacto Argentina.

Manual de Métricas e Indicadores de Impacto

Why and how to measure the environmental and social impact of your business?

News

Investments: how are the new bonds that help finance activities with social and environmental impact

Two civil associations issued Negotiable Obligations for a total of $228 million and new operations are planned, with increasing amounts; in a few days a microfinance entity with a gender asset will join; what destinations are given to the resources

Ronald Cohen: "Para dar ayuda social son necesarias inversiones, no donaciones

Sir Ronald Cohen entra en el salón del Sheraton de Retiro y las casi 500 personas presentes toman aliento e inmediatamente comienzan a aplaudir. Aunque en la Argentina su nombre es desconocido, este hombre de pelo blanco y 74 años es

Economía verde. Cuál es la agenda que se viene en el mundo y la Argentina

El pasado 26 de junio se alcanzaron los límites planetarios. Se debería haber dejado de emitir dióxido de carbono o empezar a hacerlo de forma diferente y, según el Banco Mundial, la Argentina deforesta al doble de velocidad que otros países del mundo:

Los bonos de impacto social llegan a la Argentina

Por medio de una innovadora herramienta financiera, inversores privados apostarán $ 40 millones para mejorar la inserción laboral de más de 1000 jóvenes vulnerables de la zona sur de CABA; ONGs expertas ejecutarán los programas y el gobierno de la Ciudad solo pagará por los resultados obtenidos.

- G20 DWG / GSG Engagement

At the G20 in Buenos Aires, the GSG hosted delegates of the Development Working Group (DWG) with representatives from 11 countries, the World Bank, OECD and UNDP. The group's efforts are focused on promoting inclusive economic growth, primarily through Inclusive Business. Acrux represented the Argentinean NAB.